georgia ad valorem tax refund

If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. The Department of Revenue has set up an online Title Ad Valorem Tax Calculator that you can use to estimate of the new Title Ad Valorem Tax that will apply to all.

Tax Commissioner Charlton County Ga Official Website

The property taxes levied means the taxes.

. Individual Income Tax refunds issued net of voided checks. Ad Valorem Tax Refunds. Related to Ad Valorem Tax Refunds.

The TAVT would have imposed a 65 tax on the purchase of truckstractors titled in Georgia. The most common ad valorem taxes are property taxes. The State of Georgias net tax collections in October approached 271 billion for an increase of 2302 million.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Pay Annual Ad Valorem. MV-30 Georgia Veterans Affidavit for Relief of State and Local Title Ad Valorem Tax Feespdf.

Please refer to Form MV-7L to calculate the TAVT. The ratio was established by the General Assembly and once multiplied with your Fair Market. This calculator can estimate the tax due when you buy a vehicle.

B In all cases where the county governing authority pursuant to subsection a of this Code section has authorized the tax collector or tax commissioner to credit or refund any. Ad valorem tax is computed by multiplying the State-assessed value by the local. Can I get AD VALOREM Tax refund.

Learn about income taxes and tracking tax refunds. Find the best ones near you. Ad Valorem Taxes Prior to delinquency Tenant shall pay all taxes and assessments levied upon trade fixtures alterations additions improvements.

TITLE AD VALOREM TAX IS NO-MORE for trucks registered in Georgia under IRP and will remain free from Title Ad Valorem Tax TAVT that went into effect on March 1. Avvo has 97 of all lawyers in the US. MV-30 Georgians Veteran Affidavit for Relief of State and Local Title Ad Valorem Tax Fees.

Learn about income taxes and tracking tax refunds. If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment. In Georgia property is assessed at 40 of its appraised Fair Market Value.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Valorem Vehicle Taxes.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. For vehicles purchased in or transferred to Georgia prior to 2012 there is still an ad. Use Ad Valorem Tax Calculator.

Effective January 1 2022 this form is to be used by a dealer to show the calculation of the TAVT on the sale of a new or used vehicle only. People who have earned income in Georgia must file state income taxes.

Georgia Tax Refund Questions Answered Youtube

State Stimulus Checks 20 States Sending Out Payments

Refund Policy On Appraisals Diminished Value Of Georgia Diminished Value Georgia Car Appraisals For Insurance Claims

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Tangible Personal Property State Tangible Personal Property Taxes

Georgia S Refund Checks Property Tax Break How Much You Ll Get Back Youtube

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Where S My State Refund Track Your Refund In Every State

Kemp 1 1 Billion In Georgia Tax Refunds Begins This Week Georgia Public Broadcasting

Elbert County Tax General Information

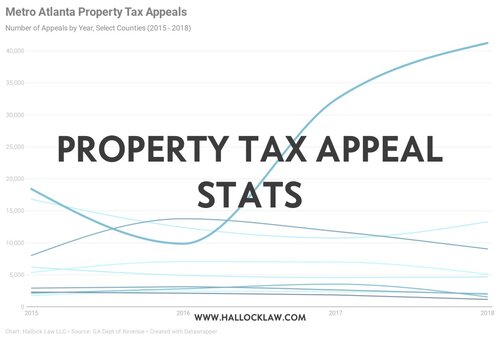

Forsyth County Ga Hallock Law Llc Property Tax Appeals

Income Tax Refunds Georgia Gov

Georgia Income Tax Rates For 2022

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

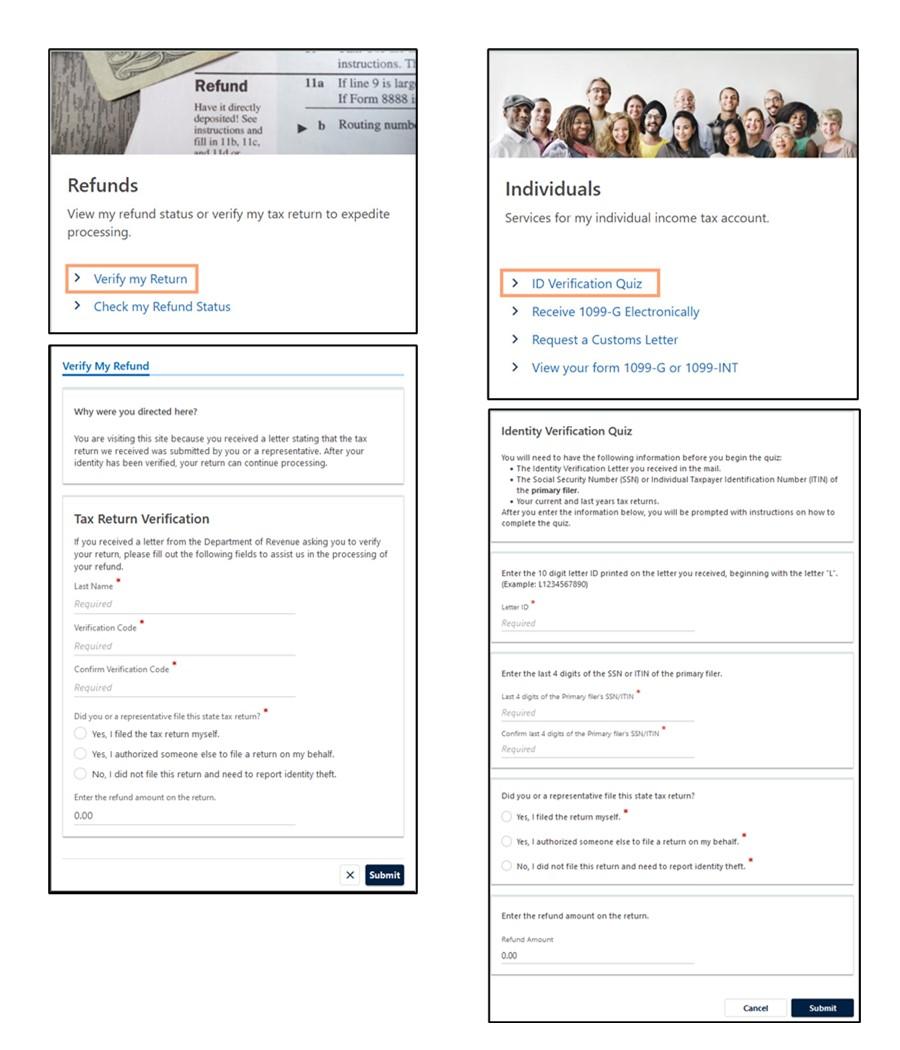

Return Verification Id Verification Quiz Georgia Department Of Revenue

Filing Georgia State Taxes An Overview The Official Blog Of Taxslayer